Accounting rate of return [ARR] is probably the oldest and simplest way to weigh your investment options.

Popular with the public sector in the US and UK for project appraisal, accounting rate of return [ARR] can also be used by you and me.

It is an easy way to decide where to put your money, or where not to put your money…

Don’t know how to use this popular tool?

Let me show you how…

Say you decide to get into the transport business. And you have 3 investment opportunities before you.

Buy a Toyota Corolla and join the Uber business?

Buy a tricycle (Keke Napep or Maruwa) and get a rider to generate weekly returns?

Buy a motorbike (Okada) and get a rider to generate weekly returns?

Using the Accounting Rate of Return, here is how you’d decide…

But first here are a few details you should bear in mind.

Note 1: You plan to buy any of the assets [car, tricycle, or motorbike] and sell them at the end of 3 years.

Note 2: Accounting Rate of Return = Yearly Net Income/Actual investment

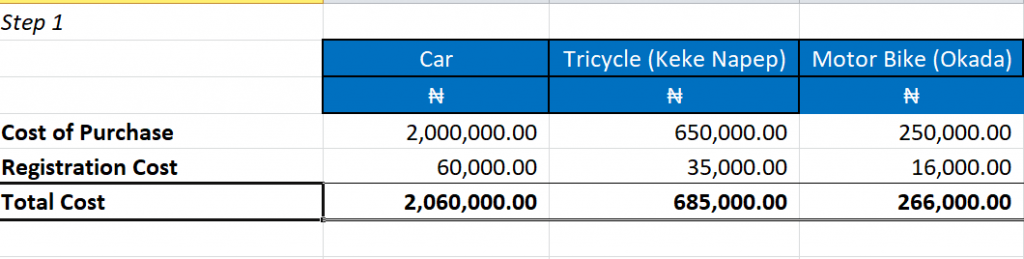

Step 1: Total Cost

Calculate the total amount you’d spend if you chose any of the options before you.

Remember that aside the heavy capital required to buy a car, tricycle or motorbike, you also need to register them before you start in business.

So here you need to add registration cost to generate your total cost.

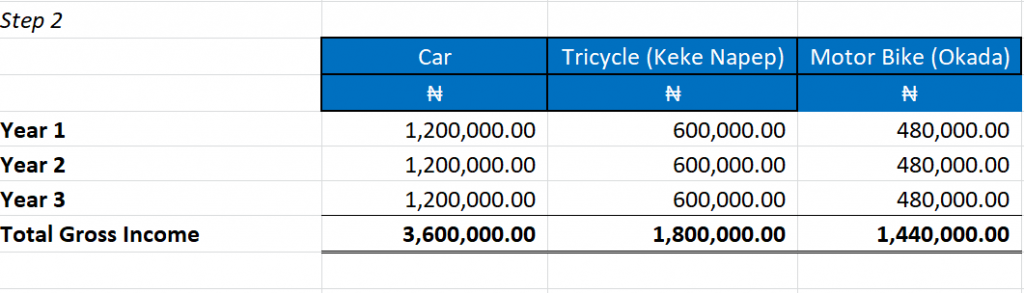

Step 2: Total Gross Income

Gross income is the total money you’d get before you remove expenses.

Imagine what each investment option will earn on a daily, weekly, monthly and yearly basis.

Then calculate the total income each asset will generate throughout the 3 years you plan to be in business…

Here is how to do this…

If you choose to buy a car and get an Uber driver, you get ₦100,000 monthly from the driver. This becomes ₦1,200,000 in a year. And in 3 years, you’d have ₦3,600,000.

Going for the tricycle, you get ₦50,000 monthly from the rider. This becomes ₦600,000 in a year. And in 3 years, you’d have ₦1,800,000.

If you settle for the motorbike and get a rider, you get ₦40,000 monthly from the driver. This becomes ₦480,000 in a year. And in 3 years, you’d have ₦1,440,000.

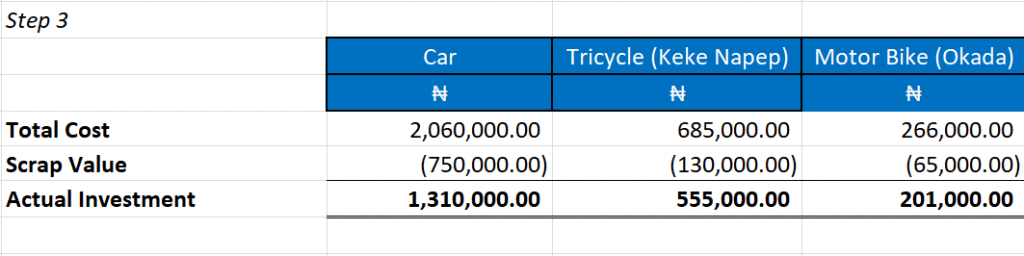

Step 3: Actual Investment

This is straight and simple.

At the end of 3 years, you’ll sell off the asset and move on.

Now how much do you think a willing buyer will pay after you’ve used the asset for 3 years?

This is your scrap value…

To get your actual investment, you need to remove the scrap value from the total cost.

This is the money you actually spent to start this business.

The money you get after selling the scrap is extra cash that must be removed from the initial total cost.

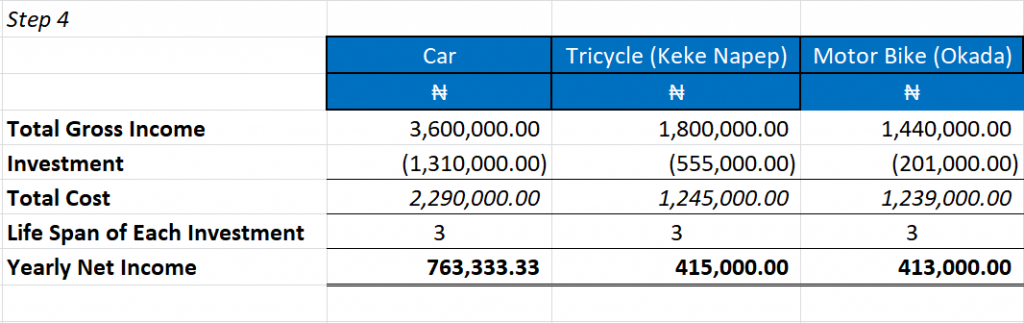

Step 4: Net Income

This is the amount that should hit your bank account every year if you choose any of the options before you.

Here is how to calculate it.

Remove your gross income from your actual investment amount.

Then divide your result by the number of years you plan to have your asset in business (in this example, 3 years).

That’s your Yearly Net Income.

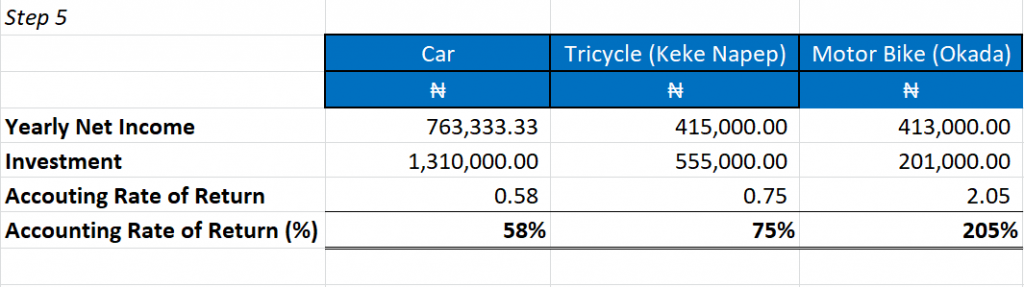

Step 5: Accounting Rate of Return

So how do you get your ARR?

Divide your yearly net income by your actual investment. The answer you have is your ARR in decimal form.

To get it in percentage, you need to multiply by 100.

Interpretation

Having a percentage isn’t enough. What does the number you have mean in a real investment situation?

In a real life situation, you choose the investment option with the highest ARR.

There’s no second-guessing here.

Caveat on Accounting Rate of Return [ARR]

Because ARR is basic, it does not worry about many variables. Here are some of them…

- Risk present in each option

- Inflation during those 3 years

- Time value of money

Word of Advice: If you’re just starting out, don’t bother about these variables. Just stick to the simple way.

Leave a Reply